Business

Small Social Security COLA Raises Worries of Financial Hardship Among Retirees in the Near Future

Several seniors may find it difficult to make ends meet in the face of persistently rising inflation that is quickly depleting their purchasing power, even with the slight increase in Social Security benefits for the cost of living that takes effect next year.

According to a recent Atticus survey, a resounding 62% of seniors who receive Social Security are unhappy with the 3.2% rise in the benefits that they would receive in 2024.

Indeed, almost twenty percent of seniors receiving Social Security expect to look for work next year because of the slight rise, and nearly three out of five seniors reported struggling financially as the cost of basic needs like food, rent, and medical care remain uncomfortably high.

Concerns about rising energy, insurance, heating, and food prices were voiced by retirees. Beginning in January, the larger Social Security benefits will be given to almost 66 million Americans who are eligible recipients.

The payment increase is a sharp drop from 2023, when recipients saw the largest increase in four decades—an 8.7% increase. It is still more than the average growth of 2.6% during the previous 20 years, though.

This kind of increase would add roughly $59 a month to the average $1,907 retirement payment.

Retirees, however, express concern about keeping up with persistently high inflation despite the salary rise. The consumer price index is still higher than the Federal Reserve’s 2% target, despite a significant decline from a peak of 9.1%.

Furthermore, prices have increased by a startling 17.23% since January 2021, before the onset of the inflation crisis.

Even if inflation has decreased, 68% of pensioners surveyed separately by the Senior Citizens League said that their household expenses are still greater than they were a year ago. They claimed that throughout the past year, this condition has continued.

According to Mary Johnson, Social Security and Medicare policy analyst at the Senior Citizens League, “worry that retirement income won’t be enough to cover the cost of essentials in the coming months” is a top issue for 56% of poll respondents.

The consumer price index for Urban Wage Earners and Clerical Workers, or CPI-W, for July, August, and September is used to compute the yearly Social Security change.

Business

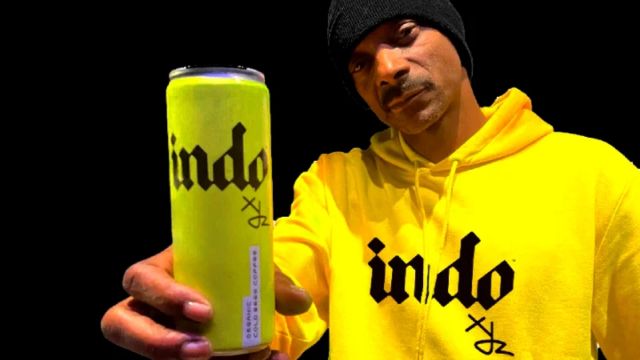

Snoop Dogg Introduces Line of Hemp-Infused Beverages in Latest Business Venture

The most recent development in Snoop Dogg’s smoking evolution has been formally revealed! Do It Fluid, a hemp-infused beverage brand from the legendary Hill Beverage Co. and Death Row Records, debuted today. It offers a healthier alternative to traditional smoking by using premium, all-natural ingredients without sacrificing the high.

Snoop Dogg stated, “Hill Beverage Co.’s vision for cannabis beverages was the perfect transition as I take the next step forward in my smoking evolution.” “What we have produced is a delicious, all-natural substitute that keeps users feeling high all day and night long,” the team said.

The line, which offers four robust flavors—Blue Razz, Blood Orange, Peaches N Honies, and Cherry Limeade—in 12-ounce CBD-only and 8-ounce blends with Delta-9 and THC, is the ideal choice for any kind of drinking event, day or night.

“It is a testament to the new direction the cannabis industry is heading that I took my passion for cannabis and curated an all-natural high alternative for consumers that is both bold and fulfilling in flavor,” stated CEO and Founder Jake Hill.

“Whether or not customers are familiar with the cannabis market, we are excited for them to experience the line. Our debut line alongside Snoop Dogg and Death Row Records is the perfect way to cement our brand within the cannabis and beverage space.”

The team is proud of Do It Fluid’s ability to provide both traditional and non-traditional cannabis consumers with a pleasurable high while pushing the boundaries of taste profiles, strength, and all-natural ingredient utilization.

To encourage a better lifestyle through the line—no guilt associated with consuming too many calories or sugar—the team also placed a strong emphasis on natural sugars, fruit juices, and tastes.

Business

Amazon Issues Apology to ‘Offended’ Employees Over Flyer Encouraging Contact with Mascot

An effort to give back during the holidays went wrong at one Amazon warehouse in New York, at least for one employee who lost it over a poster asking them to submit a letter to the company’s mascot, Peccy, detailing their financial difficulties.

“In essence, they ask you to share your struggles and how difficult the holidays are for you. According to a source from The Guardian, Keith Williams, an employee at the Amazon SWF1 warehouse, stated, “If we feel it’s sad enough [then we’ll] give your family some help.”

The Rock Tavern, New York warehouse where Williams works has a flyer at the bottom that employees spotted. Peccy is an orange blob-like creature that represents the internet shopping behemoth.

Following up with Fox News Digital, an Amazon representative said, “This was a well-intentioned holiday-giving initiative that received a lot of positive feedback from employees, however, our team is aware of the potential negative perception it created and apologize to anyone who may have been offended.”

The words “Are you or someone you know facing financial hardship this holiday season? “hovered above the mascot. Peccy wishes to assist! Address a missive to Peccy. Some of your holiday dreams can come true if you are chosen by the Peccy team!”

Amazon claims that it was a component of programs that certain specific locations carried out for the good of their staff or the community at large.

The corporation said that it is the nation’s top employer in a report from September of last year, and it stated that it is “investing $1.3 billion this year [2023] toward pay increases for customer fulfillment and transportation employees.”

According to the same article, employees start at $17 per hour, but their average wage is $20.50. This information spurred others to condemn the flyer and demand pay hikes.

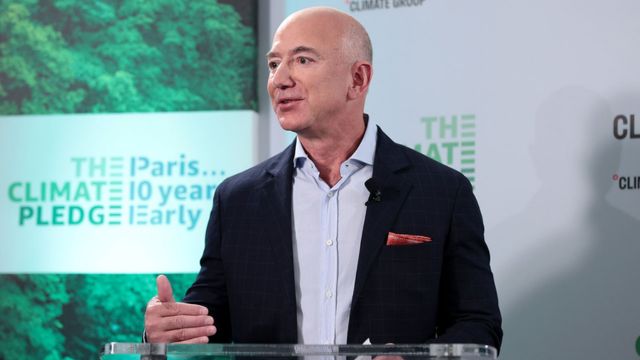

Nonetheless, some earn up to $28 per hour. According to a report published in The Guardian, the company’s profits in the most recent quarter tripled to $9.9 billion, while revenues in the three months that concluded on September 30 amounted to $143 billion. Jeff Bezos, the CEO of Amazon, is also among the richest persons on the planet.

Williams is requesting more pay, as are other workers at the Rock Tavern warehouse.

“All we’re requesting from Amazon is that they use their billions of cash to do what they are capable of doing. According to The Guardian, he stated, “We just want to share in some of the efforts that we do for Amazon.”

“We demand pay. Not accessories. For us, they have raffles. Instead of merely providing us with the safety and security of a livable salary, if they see us working hard, they’ll give us three tickets, and out of all the people here putting tickets in, we might get anything. Alternatively, they’ll put a Peccy pin on our desk so everyone knows we’re doing fantastic.”

Business

Higher Contribution Limits Announced for 401(k)s and IRAs in the Coming Year

With still-high inflation, Americans can fight it out by contributing more to their 401(k) and other tax-deferred retirement plans in 2019.

Employee 401(k) contributions will be capped at $23,000 starting in 2024, up $500 from the current limit. The Thrift Savings Plan of the federal government, most 457 plans, and other retirement savings accounts such as the 403(b) plan are all affected by the hike.

Savers age 50 and above will continue to receive catch-up contributions of $7,500.

Additionally, the IRS raised the maximum contributions to IRAs; for 2024, the cap was raised from $6,500 to $7,000 by the IRS. $1,000 will continue to be the maximum catch-up contribution for IRAs.

Although the IRS adjusts for the cost of living each year, the increases are more pronounced and have a greater effect on taxpayers during periods of high inflation.

Based on a recent Congressional Research Service analysis, only 8.5% of individuals who make contributions to retirement accounts reached their maximum in 2018.

perks of receiving social security Next year’s 3.2% pay increase: TRY TO ESTIMATE HOW MUCH YOU MAY WIN

With the most recent modifications, a greater number of Americans may be eligible for Roth IRAs, which eliminate taxes on contributions made up front and let people grow their investment gains tax-free (as long as they don’t take them out before turning 59½).

Ahead of 2023, the IRS’s most recent income phaseout will increase for heads of households and individuals from $138,000 to $161,000, up from the previous range. For married couples filing jointly, the phaseout will rise from $218,000 to $228,000 to $230,000 to $240,000 over the prior range.

A recent study by the professional services network PwC found that one in four Americans lacked retirement savings. As to the data, there is a significant retirement savings shortfall of $3.68 trillion among U.S. families that have persons between the ages of 25 and 64.

Approximately $65,000 was the typical retirement account balance in the United States in 2019, according to information from the Federal Reserve.

-

Business4 months ago

Business4 months agoAmazon Issues Apology to ‘Offended’ Employees Over Flyer Encouraging Contact with Mascot

-

Business4 months ago

Business4 months agoSnoop Dogg Introduces Line of Hemp-Infused Beverages in Latest Business Venture

-

Business4 months ago

Business4 months agoFormer McDonald’s Chef Claims Walmart Offers Copycat Version of Breakfast Sausage

-

US News5 months ago

US News5 months agoHead Coach Brandon Staley of the Los Angeles Chargers Parted Ways With Former NFL Cornerback Richard Sherman

-

Local News5 months ago

Local News5 months agoTurkish Legislator Suffers Heart Attack After Warning of Divine Retribution Against Israel

-

Business4 months ago

Business4 months ago2024 Predicted to Witness ‘Largest Financial Crash’ by US Economist

-

Crime News4 months ago

Crime News4 months agoIran Executes ‘Child Bride’ Convicted of Husband’s Murder Despite Global Appeals for Mercy

-

Crime News4 months ago

Crime News4 months agoMan Accused of Killing Mother and Grandmother, Citing Lack of ‘Head Shots’ as Unintentional